The Madrid Report on Tesla

Tesla, a Momentum, Cult, News/Event Driven, Overvalued Stock.

July 20th, 2015

Contents

- Abstract

Introduction

What drives the share price?

Bubblelicious, there is never enough of a good thing

Valuation and Tesla Fundamental Analysis.

The anatomy of the 500M asset based credit facility

The financial status of the company and the departure of the CFO

Technical Analysis

Tesla, promises, promises of a Cult Stock

The X Factor

- What are the estimations for Q2Y2015 ?

24.4% Short Float, The Big Bear on Elon’s shoulders

Today Bulls are Tomorrow Bears

Never a smooth ride, the Associated Risks

Green technologies and how green are electric vehicles

Future valuation and industry competitors

- The early bird gets the worm but the second mouse gets the cheese

- Tesla model E an all-Electric sedan for the masses

- Performance comparison with industry

- The Lithium Factor

- The options granted to the Tesla insiders

- Denial is strong with this one

- Mass Psychology

- Conclussions

- References

Abstract

Trading Tesla requires to understand the company, the elements that drive its share price, its valuation, current and future and the nature of the market trading this stock.

Trading any stock requires the investor or trader to be aware of the elements that pose a risk and those that are a key success factor for the company and the share price. In the case of Tesla the metrics are different from the regular stock or even the companies in the same industry.

Tesla is a Momentum stock, a cult stock and it's very sensitive to news and events. These elements give the stock a high volatility and very particular specific factors to assess its valuation.

Each investor is different and has different goals, this document is not a recommendation to buy or sell a stock in a particular timeframe.

Introduction

Sir, I have a tulip bulb I can sell you for $100,000 USD, a bargain!! while supplies last.

Probably you're laughing out loud by now because you could easily find the ten pack tulip bulbs for $3.98 at your local home improvement store. As a matter of fact those were really cheap tulip bulbs back in 1637, considering the price of a single bulb reached a peak price of $278,000 during the dutch tulipmania[23].

The specific Tesla case, Tesla is a Momo, Cult, News/Event driven (way) Overvalued stock. What does it mean? let's start with an abstract from the Schirach report on Tesla [19]

“Consider this. Right now, the market capitalization of Tesla is about $ 26 billion. And yet Tesla makes only 33,000 vehicles a year. Fiat Chrysler is worth about $ 20 billion, considerably less. And yet Chrysler made 1,8 million vehicles in the US 2012. The group’s worldwide production was 2.37 million. Ford is worth about $ 60 billion, a bit more than double Tesla's value. But Tesla’s total annual production is the equivalent of the number of cars Ford makes in one day. Got that? A full year production versus just one day.

How about another interesting comparison? As a recent WSJ article put it: “Tesla sells about 90 cars a day. GM sells 90 every five minutes. But Tesla is worth nearly half as much as GM.

And, by the way, Tesla is not profitable. In the first 9 months of 2014 it lost $ 186 million.”

Price and Value are two very different concepts that must be tracked closely to detect when a tulip like market is forming. Market doesn't have memory and the dutch tulipmania story has been repeated several times and can be repeated anytime, anywhere and in any market.

|

| When prices irrationally go higher and price meaningfully diverges from value a bubble has formed |

What drives the share price?

Going back to the basics, what defines the share price is pure and simple supply and demand. The more buyers for a stock the higher the price, the more sellers the lower it goes. Common sense says that if the company is profitable, stable, financially healthy, and pays attractive dividends it will become appealing to more investors who will increase the price of the share by becoming buyers in a possible long term holding of the stock, however common sense is the least common of the senses, especially when it comes to price and valuation.

With enough thrust even a brick will fly, same applies to the market, to increase the share price just keep getting enough buyers with enough buying power to create an imbalance that will lift the price, as simple as that. The drawback of this approach is this could reach an irrational divergence between price and value which consequently can inflate price bubbles.

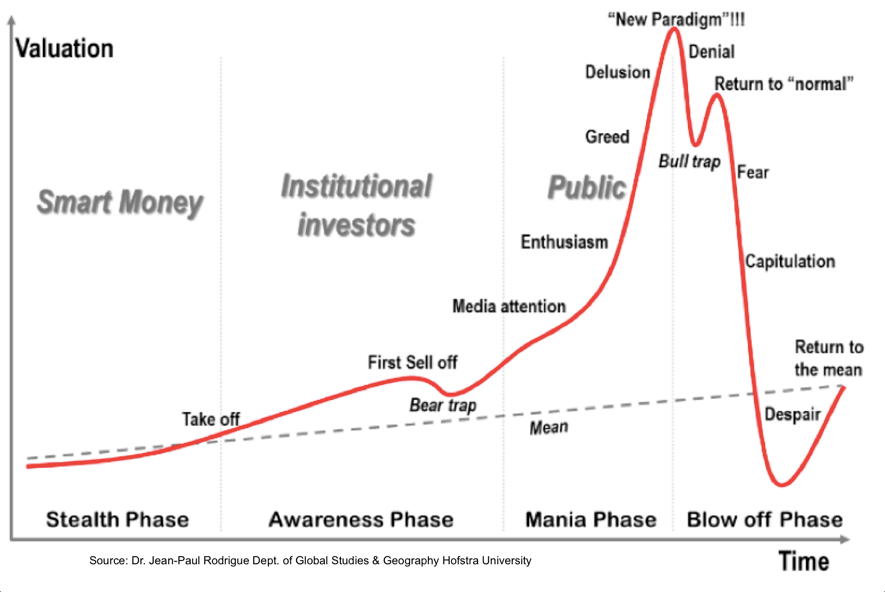

Bubblelicious, there is never enough of a good thing

There have always been numerous bubbles in markets throughout history, this is not new, humans never learn the lesson and there is never enough of something “good”. A bubble is created when the supply demand law makes the price irrationally high compared with the real value of the underlying asset. Even if investors are aware of valuation and the price divergence, they don't care, nobody wants to be left behind in a skyrocketing opportunity. It’s normal to find bubbles and overvalued companies in the market, but how much is too much? From the rational analytical perspective there is no answer, from the pure market perspective, "as long as the music plays, keep on dancing", when the music stops that is the sign the peak has been reached and that is why it’s practically impossible to predict it, nobody really knows when buyers will stop buying and will take profits to become sellers.

|

| "Patterns are repeated.. over and over, with slight variations, because human nature never changes" ~ Jesse Livermore |

Price always follows value, not the other way, that’s a market law. During the dutch tulip bubble[1][23] people could sell their farms, their hoards, get loans, sell grandma's jewelry and everything they could to enter this market willing to pay the equivalent of a quarter million dollars for a tulip bulb with a book value of that of an onion. When the market started to take profits and they found it was difficult to find more buyers, the prices plummeted and finally the price met its real value. Would you buy a tulip bulb for the price of a house today? That is not what investors thought at that time when the bubble clouded their reasoning by making them think prices would go up forever. This is the first sign of a bubble in an euphoric market.

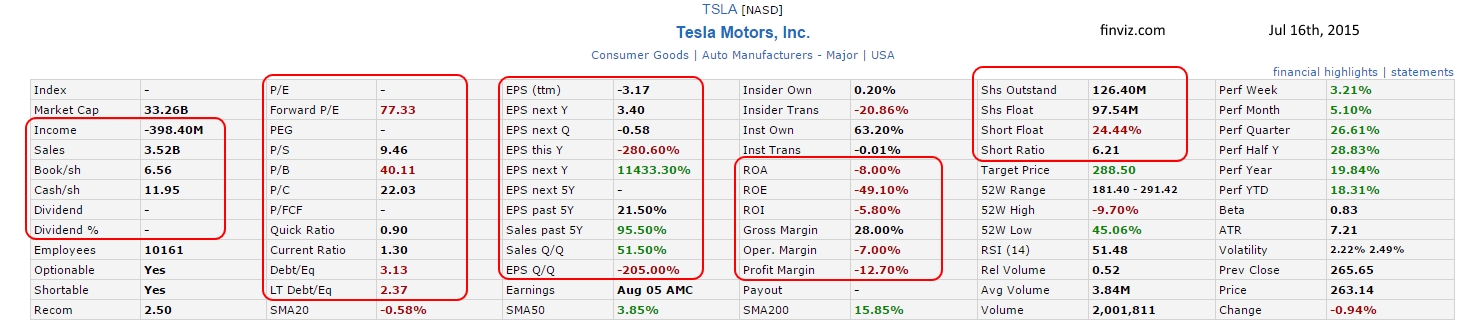

Valuation and Tesla Fundamental Analysis.

Let’s see how Tesla is valuated as a company. Taking a look at the cold financial numbers of Tesla, we found the following outstanding metrics:

|

| Financially in the Red walking with a Big Bearish short float mounted on its back |

Income = -398.40 (losses)

Book/sh = 6.56 This is the book value of the company

Price/Sales (P/S) = 9.46 (overvalued compared with the industry average)

Price to book (P/B) = 40.11 (way overvalued)

EPS = -3.17

EPS Next Q = -0.58

EPS this Y = -280.60%

EPS Next Y 11433.30% (What?!!!)

These numbers mean currently Tesla is not generating income but loses, its numbers are red, and even though its sales have increased quarter over quarter, the amount of Capital expenditures are astronomical and Tesla keeps on burning cash at ludicrous speed, the expenditure is exceeding the gross company income. The Earnings per Share are also negative, and the estimates for next quarter doesn’t say those will be positive, but those will be less negative, so it assumes the next Earnings Report will show less losses. I give the benefit of the doubt but the numbers of deliveries disclosed on the 2nd of July weren't convincing enough for the market to ignite a trend above the all times high level.

How much are you paying for this tulip bulb known as Tesla share? The book value is $6.56, yes but currently this stock is trading at 266.68 which means the market is willing to pay 40+ times its book price for a company that is not profitable and is burning astronomical amounts of cash.

Let’s dig a little more in Tesla’s financials, this year Tesla has offered a negative 280.60% EPS, and it is estimated they will report a positive 11433.60% next year. Wow, going from negative and losses to an astronomical 11433% in 12 months with a target price of 288.50 according to finviz (there are analysts whose target prices are way above that). This is the only company offering this huge projected EPS for next year, which is either too good or too surrealistic. When something sounds too good to be true, most probably it is too good to be true.

Profitability is a word that doesn't currently exist in Tesla's financials vocabulary, with a return on equity (ROE), return on assets (ROA) and return on investment (ROI) on the red plus an operation margin and profit margin also in the red the answer is an absolute No, Tesla is not profitable.

Is Tesla solvent? This is a good question, because if the income is offset by the expenses to put it in negative financial territory then they must be getting financial support from somewhere else. Bonds, yes! why not? if you run out of cash then issue debt bonds. Not too fast … you can do that if you have a good credit rating, however the bad news for Tesla is that its bond rating is Junk [2]. Looking at the numbers its quick ratio (Company’s liquidity) says 0.9, so it is not at 100%, I raise a warning here. and the current ratio (resources to pay company’s debt) is at 1.30, which means liquidating all Tesla’s assets it can deal with its debt, which makes it suitable for an asset based revolving credit facility.

The anatomy of the 500M asset based credit facility

Elon Musk must raise $1.6B to build the gigafactory, so let’s look for plan B, direct bank credit [3] a secured asset based revolving credit facility for $ 500M with Deutsche Bank, Bank of America, Goldman Sachs, JPMorgan Chase, Morgan Stanley, Wells Fargo and Credit Suisse due on June 10th, 2020, so the plans of building the Gigafactory can continue and eventually the release of model 3. What it strongly comes to my attention is that Bank of America, Deutsche Bank, JP Morgan downgraded or maintained a downgrade analyst rating on Tesla, Credit Suisse maintains an overweight rating. Logic says if they know the company and if they are the Tesla lenders until 2020, they are supposed to lend money to someone they think will succeed, but their ratings say otherwise. Well, financial logic doesn't seem to prevail with Tesla lately.

The financial status of the company and the departure of the CFO

In the market nothing happens by chance, each announcement, every event, corporate key positions arrivals and departures have a purpose. During the shareholder meeting on June (a.k.a. the vegan meeting) it was announced the departure of Deepak Ahuja. Looking at the fundamentals, the debt level, the capital expenditures my personal opinion about it is that he left knowing that the company financial status is a mess and it could get uglier overtime, it is a wise man's prerogative to know when it is the right time to leave. I don't want to speculate on this, but in my very personal opinion if someone in a key position is not delivering results or isn't in line with the company's direction the best course of action is to give the opportunity to someone else as smoothly as possible so no ripples are generated in a news/event driven market.

Technical Analysis

We have already taken a look at the Company fundamentals and we determined it is (way) overvalued and non profitable. Let’s take a look at the technical analysis to evaluate the stock performance and its possible outcome.

The pattern shown by Tesla is the dreaded Head and Shoulders forming with a right shoulder at the 260 level, the head at 284 and the neckline at 181. This pattern is very aggressive and it could have taken the share price to around $100. It wasn’t activated, even though the market reacted extremely cautious and there was some sort of delay that derailed the uptrend it had from the 180 level. The bear sentiment grew at that level, but there were a couple of events, the Tesla shareholder meeting and the order numbers report that drove the share price to 280, and which was not enough to break the all time highs and created a pattern that triggered the recent strong bear sentiment that dragged the price back to the 250-ish level. Recently during the ludicrous speed announcement (very well timed by the way) the price closed at 274.66 on Friday 16th. The pattern formed was then a double top, not as bearish as the head and shoulders, but if the all time highs is not broken and maintained then a triple top can still form and discourage the market creating a strong reversal that can take the price back to 180.

|

| Head and Shoulders pattern |

The risk at these levels is high, and anybody with basic knowledge in technical analysis and pattern recognition skills knows that. However the events which happened at very specific levels and with a very well timing reignited the “Hope Trading” and the market morale high enough to not to give up on this one. This gains time before the 2Q2015 earnings report is released with more accurate delivery and sales numbers.

|

It can be a head and shoulders, or a double top.

Whoever wins ... we lose. |

In a normal market the patterns work as expected, when they don't then something else is driving the market and more detailed analysis is needed to determine what's the driving factor

There was an event that spooked the market, during one of the Elon’s presentation a rumor spread about delays on Model X. This was enough to make investors run when they sensed one of the slides implied this. This gives a clue about why the stock keeps its current price in spite of negative valuation and dreadful bearish chart patterns.

Tesla, promises, promises of a Cult Stock

According to Investopedia [4] a cult stock is “A classification describing stocks that have a sizable investor following, despite the fact that the underlying company has somewhat insignificant fundamentals. Typically, investors are initially attracted to the company's potential and accumulate positions in speculation that its potential will be fulfilled, providing the investors with a substantial payout."

Jim “Cramer has always defined a cult stock as one that is very hard to value because it does not trade on traditional valuation metrics. ” [5]

Tesla is a Cult stock, so everything discussed as traditional valuation metrics does not necessarily apply to this one. What is so big that keeps the market attracted to it? Tesla doesn't show a present but a future valuation, a promise made by Elon Musk to reach 50% annual growth and deliveries of 500,000 cars a year by 2020.

Elon Musk declared that Tesla won’t be profitable until 2020 and until they reach that 500,000 cars sold he estimates Tesla would go back in black under the GAAP (Generally Accepted Accounting Principles) rules [6].

Forget about everything else, what currently keeps the valuation high is nothing else but the delivery numbers that will keep the company guidance in line with the market expectations. That is the reason why the market immediately reacted negatively when the rumor about a delay of Model X was spread. If Tesla misses the delivery estimates the price will tumble because this would mean the market won't see the future as it was depicted.

On Q2Y2105 Tesla delivered 11,507 model S, On Q1Y2015 the number was 10,030, which totals 21,537 of the 55,000 promised for 2015, this means they need to deliver 33,463 by the end of the year and the current level of Model S deliveries is not enough if the next two aren’t record breaking quarters too.

Tesla has reached 39.16% of the goal at half year, it needs to catch up with the other 60.84%.

And don't forget that last year Tesla announced they were ready to deliver 100,000 vehicles and this year they lowered their own bar. Tesla said they have 20,000 model X booked with the $5,000 USD down payment. As soon as the model X is rolling out of the plant and being delivered to customers that number is another promise that Tesla must honor if they want to keep on track with the goals. How many of those 20,000 model X will be delivered this year to count towards the goal? how is the chinese market going to behave after the recent market turmoils that forecast the end of a bull chinese market and the entry to recession? How is Greece going to affect the European market and how is the global car industry going to react are factors that potentially can derail Tesla from meeting these numbers.

So far the deliveries of the Model X are crucial for Tesla to meet its delivery goals by the end of year, any bad news related with Model X will make the market extremely reactive considering the market has been very patient with the past delays of Model X. Model X is a critical success factor for Tesla today, more than ever.

The X Factor

Market keeps an eye on the Model X. Patience is a virtue, but if this is taken to the extreme this can be lost. Model X has been delayed for a long time, and I am surprised the waiting list is claimed to have 20,000+ with some cancellations that don't seem to affect the overall estimates. How many of those 20,000+ can Tesla produce and deliver before the end of the year is a critical factor to maintain Tesla in track with the promises it made about the 55,000 deliveries for 2015 plus the 50% yearly growth and the 500,000 annual deliveries by 2020.

|

| Market paid 40+ the value of book for a promise. Either it is honored else ... |

The amount of cash the Research and Development (R&D) expenditures category Tesla has incurred so far plus the astronomical Capital Expenditures (Capex) are taking the company to huge debt levels and model X becomes a crucial factor to get fresh cash before they run out of it and the market runs out of patience. The delays of model X have been due to a numerous technical reasons, among them the problem with the falcon wing doors, the power needed to move this heavier model, safety issues, etc. Original, pretty, but complicated because they had to solve engineering problems like the sealing, the support on the roof, which unlike the traditional horizontal doors the falcon wing doors have to have a stronger reinforcement on the ceiling to avoid it to bend due to the door weight. There are several reasons why the falcon wing doors are not popular, try to open those during snowy or rainy days, regular doors let water and snow come inside the vehicle, the falcon wings aperture hole is a big welcome to inclement weather. This is not another EV, so the technology developed for the batteries before model X is not enough to move a heavier vehicle and give it an acceptable autonomy range. In the case of an unfortunate accident, the doors could trap occupants inside the vehicle if this flips over. All of these engineering hurdles had to be solved first and they had to make sure they are fully fixed before delivering the SUV or they'll have to face recalls and lawsuits they don’t want.

|

In 2014 he said 100,000 by 2015, in 2015 he lowered it to 55,000 [28]

|

|

On 2014 Tesla declared they were ready to produce 100,000 cars in 2015. However they lowered their own expectations to 55,000. Public media said this could be interpreted as lowering their own bar so they could pass the test. Definitely a very patient Tesla market.

Thinking about a SUV first thing that comes to my mind is the classical picture of the SUV, with the family around the bonfire kids riding their bikes, the lake in the background, and the ... hey wait !! the lake, it means there should be a canoe right? or at least an inflatable boat plus all the baggage needed at the camping site for a couple of days, right? and don't forget the kids riding their bicycles. Well, where is suppose to be the boat and extra luggage placed? on the roof rack I guess, well not with this one, since the falcon doors won’t give any additional room to install a roof rack on top of the vehicle, so kids forget the bikes just go tracking, and we'll just watch the lake comfortably sat here. Probably this won't be exactly the kind of SUV for the adventure, and being in the middle of nowhere far from electric outlets and superchargers could make the owner think it twice before taking the family on such a journey. The point here is probably if you're a mud lover and like the adventure you could get a chevy Tahoe with ecotec engine. Model X is more like the city girl/boy family car for those who want a social status badge and are green cause enthusiasts who are in favor of saving baby polar bears.

The X factor is going to gravitate too much in future market valuation. The current price share and the outstanding market performance are starting to become too good to be true. Elon is literally a rocket scientist capable of launching a rocket to the international space station and back. His technological achievements and his dreams of the future world are amazing, if he was able of this then he can do anything, at least that is what has gained him a vote of confidence from the market since the beginning. The market is not emotional, and if the numbers do not match the forecasts and expectations it can change its mind, nothing personal, just business.

What are the estimations for Q2Y2015 ?

According to estimize.com, Wall street is estimating -0.61, notice the trend, it is not targeting at a higher estimation compared with previous quarters, so during the earnings report what we can expect is either a number that meets or exceeds Wall St. estimations and everybody can be happy to beat estimations, what it really means Earnings were not good, not even positive, but were less bad than expected. This is another case of lowering the bar. If it misses, let's see how far was Wall St. from the actual numbers. What it really matters is the guidance, the actual deliveries, production and inventories. We won't have delivery numbers from model X since it is expected to start deliveries in two months (September 2015), so we depend exclusively on model S numbers, which I expect them to be lower than the number presented on July 2nd after the warning issued in the same presentation (there may be small changes to this delivery count).

24.4% Short Float, The Big Bear on Elon’s shoulders

There is a segment of the market who is more skeptical about Elon’s promises and which has kept a more realistic foot on the ground. There is a large segment in this market who thinks the promises based on future Tesla’s valuation are way too ambitious and lack of realism. As of July 17th, according to finviz, tesla has a short float of 24.44%, which means that approximately one in four floating shares is shorted by the market, the amazing fact is that even at levels close to the all time highs this number has not backed off. So there is a strong conviction from the Bears that the company, based on its current valuations and the hurdles it has to go through won’t be able to meet the promised delivery numbers. This Tesla bull market is very nervous and any number that falls short of the goals will be enough to press the sell button. This stock is extremely reactive to news and events which gives it a large volatility and very strong swings not suitable for the faint at heart.

|

| Bad news, Tesla short float is 24.44%, good news!, it is lower than the 37.64% of its sister company Solarcity (the free sarcastic joke of the day). |

Today Bulls are Tomorrow Bears

This stock doesn't pay dividends, this is what is known as a momentum stock or momo stock. And they won't be able to pay dividends in a long time, they first have to negotiate this with their creditors and become profitable, which probably won't happen until 2020.

Tesla is a momo stock, not exactly that kind of stock that is a buy and hold "forever" as the first option, but trading strategies and goals are beyond the scope of this report. Let's understand the risks associated with a momo stock, according to investopedia [8], a momo stock is “A slang term used to describe an advanced trading strategy based purely on momentum. In a momo play, the trader is not interested in the company's fundamentals, only in the short-term direction of a security's price movement.”

So the buy and hold "forever" poses a higher associated risk with momos because they are prone to higher volatility. With no dividends paid, people who are buying to keep it forever depend exclusively on the price fluctuations of the share. Keep in mind that market in general is very sensitive to the increase of interest rates by the feds, if they start increasing interest rates, which is very likely to happen by the end of the year, there will be a lot of margin calls triggered that will make the market to exit and take profits. Today's bulls are tomorrow's bears when they'll close their trades creating selling pressure. Bulls who buy and keep “forever” should ask themselves if the market is going to increase or keep their positions when the margin calls force them to ring the bell and go to cash. Most probably no. The only way to make money with momos is by speculating with the price swings and the high volatility, momos tend to no real long term commitment and no string attached. It is valid to consider if the stock will reach the 300 limit or just like some extreme ratings suggest, 400. Why not, nobody can predict the future, but if they can forecast 400, there are others who can forecast 180 or 165 according to different analyst ratings.

Never a smooth ride, the Associated Risks

Achieving a goal isn't like a walk in the park, just like stocks, reaching a target price is a path plenty of hurdles, extreme challenges and booby traps. Tesla just like any other company has foreseen and unforeseen risks it will have to solve to reach the target numbers, and which will make the market react accordingly.

As per the Q10 SEC filing for the 1QY2015, Tesla elaborates on the foreseen risks it may face that could negatively affect the stock price. The following are just the textual headlines reported in the Q10 filing which are elaborated there in more detail [9]. The purpose to include them here, since this is a news/events highly sensitive stock, is to make the reader aware of all the different kinds of events that could affect the stock price. Quote:

Significant delays or other complications in the design, manufacture, launch and production ramp of Model X, as well as future vehicles such as Model 3

Our long-term success will be dependent upon our ability to design, build and achieve market acceptance of our vehicles, including Model S and new vehicle models such as Model X and Model 3.

We may be unable to meet our production and delivery plans for Model S and Model X, both of which could harm our business and prospects.

Problems or delays in bringing the Gigafactory online and operating it in line with our expectations

If our vehicles or vehicles that contain our powertrains fail to perform as expected, our ability to develop, market and sell our electric vehicles could be harmed.

We are dependent on our suppliers, the majority of which are single source suppliers, and the inability of these suppliers to continue to deliver, or their refusal to deliver, necessary components of our vehicles in a timely manner at prices, quality levels, and volumes acceptable to us would have a material adverse effect on our financial condition and operating results.

Our future growth is dependent upon consumers’ willingness to adopt electric vehicles.

If we fail to manage future growth effectively as we rapidly grow our company, especially internationally, we may not be able to produce, market, sell and service our vehicles successfully.

If we are unable to adequately reduce the manufacturing costs of Model S, control manufacturing costs for Model X or otherwise control the costs associated with operating our business, our financial condition and operating results will suffer.

We may fail to meet our publicly announced guidance or other expectations about our business, which would cause our stock price to decline.

Our vehicles make use of lithium-ion battery cells, which have been observed to catch fire or vent smoke and flame, and such events have raised concerns, and future events may lead to additional concerns, about the batteries used in automotive applications.

We have a history of losses and have to deliver significant cost reductions to achieve sustained, long-term profitability and long-term commercial success.

Foreign currency movements relative to the U.S. dollar could harm our financial results.

The introduction of our resale value guarantee and leasing programs may result in lower revenues and profits and exposes us to resale risk to the extent many customers elect to return their vehicles to us and the residual values are lower than our estimates.

If we fail to effectively manage the residual, financing and credit risks for our recently launched Model S leasing program, our business may suffer.

Increases in costs, disruption of supply or shortage of raw materials, in particular lithium-ion cells, could harm our business.

Our success could be harmed by negative publicity regarding our company or our products.

Our distribution model is different from the predominant current distribution model for automobile manufacturers, which makes evaluating our business, operating results and future prospects difficult.

We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

We are currently expanding and improving our information technology systems. If these implementations are not successful, our business and operations could be disrupted and our operating results could be harmed.

The automotive market is highly competitive, and we may not be successful in competing in this industry. We currently face competition from new and established competitors and expect to face competition from others in the future.

Demand in the automobile industry is volatile, which may lead to lower vehicle unit sales and adversely affect our operating results.

If we are unable to establish and maintain confidence in our long-term business prospects among consumers, analysts and within our industry, then our financial condition, operating results, business prospects and stock price may suffer materially.

We have limited experience servicing our vehicles, especially in certain regions outside of the United States, and we are using a different service model from the one typically used in the industry. If we are unable to address the service requirements of our existing and future customers, our business will be materially and adversely affected.

We may not succeed in maintaining and strengthening the Tesla brand, which would materially and adversely affect customer acceptance of our vehicles and components and our business, revenues and prospects.

Our plan to expand our network of Tesla stores, service centers and Superchargers will require significant cash investments and management resources and may not meet our expectations with respect to additional sales of our electric vehicles. In addition, we may not be able to open stores or service centers in certain states or Superchargers in desired locations.

We face risks associated with our international operations and expansion, including unfavorable regulatory, political, tax and labor conditions and establishing ourselves in new markets, all of which could harm our business.

The unavailability, reduction or elimination of, or uncertainty regarding, government and economic incentives in the U.S. and abroad could have a material adverse effect on our business, financial condition, operating results and prospects.

Our strategic relationships with third parties, such as Panasonic, are subject to various risks which could adversely affect our business and future prospects.

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position.

If we are unable to attract and/or retain key employees and hire qualified management, technical, vehicle engineering and manufacturing personnel, our ability to compete could be harmed and our stock price may decline.

We are highly dependent on the services of Elon Musk, our Chief Executive Officer.

We are subject to various environmental and safety laws and regulations that could impose substantial costs upon us and negatively impact our ability to operate our manufacturing facilities.

Our business may be adversely affected by union activities.

We are subject to substantial regulation, which is evolving, and unfavorable changes or failure by us to comply with these regulations could substantially harm our business and operating results.

We retain certain personal information about our customers and may be subject to various privacy and consumer protection laws.

We may be compelled to undertake product recalls or take other actions, which could adversely affect our brand image and financial performance.

Our current and future warranty reserves may be insufficient to cover future warranty claims which could adversely affect our financial performance.

Our insurance strategy may not be adequate to protect us from all business risks.

Our financial results may vary significantly from period-to-period due fluctuations in our operating costs and the seasonality of our business.

Unauthorized control or manipulation of our vehicles’ systems may cause them to operate improperly or not at all, or compromise their safety and data security, which could result in loss of confidence in us and our vehicles and harm our business.

We may need or want to raise additional funds and these funds may not be available to us when we need them. If we cannot raise additional funds when we need or want them, our operations and prospects could be negatively affected.

We may face regulatory limitations on our ability to sell vehicles directly or over the internet which could materially and adversely affect our ability to sell our electric vehicles.

We may need to defend ourselves against patent or trademark infringement claims, which may be time-consuming and would cause us to incur substantial costs.

Our patent applications may not result in issued patents, which may have a material adverse effect on our ability to prevent others from interfering with our commercialization of our products.

Our trademark applications in certain countries remain subject to outstanding opposition proceedings.

Our facilities or operations could be damaged or adversely affected as a result of disasters or unpredictable events.

Servicing our convertible senior notes requires a significant amount of cash, and we may not have sufficient cash flow from our business to pay our substantial debt.

We may still incur substantially more debt or take other actions, which would intensify the risks discussed above.

The classification of our Notes may have a material effect on our reported financial results.

The trading price of our common stock is likely to continue to be volatile.

Conversion of the Notes may dilute the ownership interest of existing stockholders, including holders who had previously converted their Notes, or may otherwise depress the price of our common stock.

The convertible note hedge and warrant transactions we entered into in connection with the issuance of Notes may affect the value of the Notes and our common stock.

Mr. Musk borrowed funds from affiliates of certain underwriters in our public offerings and/or private placements and has pledged shares of our common stock to secure these borrowings. The forced sale of these shares pursuant to a margin call could cause our stock price to decline and negatively impact our business.

Anti-takeover provisions contained in our certificate of incorporation and bylaws, the provisions of Delaware law, and the terms of our convertible notes could impair a takeover attempt.

The fundamental change repurchase feature of the Notes may delay or prevent an otherwise beneficial attempt to take over our company.

If securities or industry analysts publishing research or reports about us, our business or our market change their recommendations regarding our stock adversely or cease to publish research or reports about us, our stock price and trading volume could decline.

End of quote

Green technologies and how green are electric vehicles

One of the traders in the Stocktwits forum told me the reason why he was long in this stock was because Tesla is a green car. Nothing wrong with that, but before drinking the kool-aid let’s see how green are EV’s. The best answer for this one is … it depends. It is a zero emissions vehicle, no doubt, which at first glance makes it green, looks legit, but if we take a closer look at how the car moves and track its energy source, we can determine how green are EV's.

The law of conservation of energy is a law of science that states that energy cannot be created or destroyed, but only changed from one form into another or transferred from one object to another. Applying this to the EV's then we notice the energy source that moves this technology is electricity, but where does electricity come from? There are several sources, hydroelectric, nuclear, eolic, solar, and thermoelectric. In the US during 2013 the sources of electricity[10] were:

- Coal: 39.5%

- Natural Gas: 27.8%

- Nuclear: 19.7%

- Renewable: 13%

Fossil fuels (coal and natural gas) make 67.3% of the total energy generation. Nuclear energy makes 19.7% and its waste is radioactive and has to be confined. The radioactive levels decay to that of an uranium ore in between 1000 and 10000 years. Chances energy to recharge the EV come from a renewable green source are little and this is not going to change overnight. There are emerging green technologies, but changing the network infrastructure is a work that will still take a long time. That’s where humans are going, certainly, little by little, but not all countries and not as fast as we all would like.

In the world a large amount of electricity comes from burning fossil fuels[11] (coal, natural gas, petroleum) in 2008 the renewable sources of electricity in the world totaled 16% and nuclear 13%. China and USA are the two largest coal generated electricity producers in the world. Still a long, long way to go for the environmentally friendly energy sources.

The electric vehicle by itself is green because of the zero emissions, but in the big picture it indirectly burns fossil fuels or generates radioactive waste after the generated electricity to recharge it. Even EV’s contribute with their carbon footprint.

|

| How green are EV's, it depends on where how the electricity to recharge them comes from. |

Future valuation and industry competitors

Let’s first locate Tesla in the industry context. Tesla is in the consumer cyclical sector and it is an auto and truck manufacturer. As an investor in this industry the first thing that comes to mind is how much could I expect this to perform? Logic says we could expect a performance similar or in the best case scenario, somewhat above the market sector average (remember what I previously said about logic and Tesla?). As realistic investors we should be aware that the stock price will reach some reasonable multiples of its real value sooner or later (40x book value is excessive), and the value won't be that of the market cap of Apple [12] as Elon stated with a calculation made behind the envelop.

According to CNN Money [12] “Of course, that's a lot lower than the current Tesla valuation of more than 110 times 2015 profit forecasts, but 20 times earnings is significantly higher than the price for traditional auto companies GM (GM), Ford (F), Fiat Chrysler (FCAU), Toyota (TM) and Honda (HMC). It's also more expensive than Apple, which is valued at 15 times estimates.

For Tesla to get to nearly $350 billion in annual sales, it would need to sell millions of cars a year -- not tens of thousands.

To do that, everything has to go right for Tesla. The new Model X crossover will need to be a hit.”

So let's keep the feet on the ground, Tesla would have to sell millions of cars to reach a realistic high valuation in the future. Tesla is a company valued on perfection at this time. The market has allowed an overvaluation from the traditional metrics, and the key factor to keep its current overheated valuation is just to keep on track with no excuses.

The early bird gets the worm but the second mouse gets the cheese

The reason why the stock got this overvaluation is basically the same as what happened during the dot com bubble, an innovative technology, a brand new sector that breaks the paradigm of the traditional markets and a lot of potential for the future. So the market wanted to jump on the bandwagon before anybody else, sounds logic (remember Tesla stock doesn't move with logic) the share price soared based on future valuation. Nobody wants to be left behind and when the train of the stock market starts it doesn’t care, either you jump in or you are left behind and when you realize the train has long gone and who knows? probably it will never be back. But it’s time to ask, wasn't it too soon? Nobody can deny that internet is the future, but when the bubble inflated it was too early and it was very common to see cult stocks valued on future promises with struggling half built or no infrastructure at all, negative earnings, large expenditures and losses. Sounds familiar?

It took almost 15 years to see the surviving dot com companies to reach its old peak prices. Is the Electric Vehicle the future? I’d rather say, green technologies are the future, not only pure EV’s, but also other green technologies, like the hybrid, hydrogen cell, compressed air, biodiesel. Is Tesla Alone in the market? [14] no, Tesla has to compete against monsters who have always been there and who have a largely developed assembly and distribution infrastructure like general motors, honda, tata, Nissan, Ford, VW, Toyota, BMW, as well as other Chinese companies, and all of them are stubborn and determined to fight till the end to stand their ground. The merit Elon has is he was the first to take the challenge to show there was a market for EV’s for the common people, his professional background and his achievements in his different ventures gained him a lot of credibility and a vote of confidence. By the way, he didn't invent the EV, this technology was made first available in 1884 by Thomas Parker [20].

In 2013 Tesla share price rose from the 30's to the 180's level in a matter of six months, it is 600%. Of course that is going to be like the chant of the sirens. But what was there really? even with negative fundamentals the smart money decided to endorse Elon Musk, keeping in mind the future goals, and thinking that jumping early at an emerging technology could guarantee their golden ticket to Wonka's factory, then the big money jumped in the trade. The 180 level became a strong support and it has been tested several times. The fear of a Head and Shoulders pattern is that the level could break that support and bring the prices back to 125. After the 180 level we find the speculative money, short term traders, and swing traders. This is a momo stock, so traders swing it according to the trends formed after the 180 level. Will there be more upside? The smart capital is between 30 and 180, unless an outstanding surprise is under the hood of Tesla, I don't see any solid element to trigger prices above 300. The future price of Tesla has already been set in the present time, the early birds are already positioned. The smart market know they have already paid for the Elon's promises and they're in a wait and see mode. Unless something goes terribly bad they would exit their position below 180. There have been some speculators who have been trying to break the price above 280 by playing the recent events, but they have failed, resulting in peaks and fades. Their goal is to force a short squeeze above 280. If they're successful probably they could scratch that level, but I see a very stubborn, determined and fearless Bear even at 280. The short float at 24.4% means Bears have conviction. This level is a key factor to identify if Tesla is really going to break the all time high and reach an even higher price. In the mean time I expect swings inside a large trading range between 180 and 280.

Performance comparison with the industry

Once the euphoria settles and the reason comes back on this one, how much can we expect as a real profitable company valuation? [15]

Revenue, net income and net income margin are in the negative, which is not surprising after the perspective of the valuation of a cult stock, those must go back to the positive territory. Currently the research and development expenditures (R&D) compared with the competition are high, it means Tesla is in the development phase, with a long way to go until 2020 when it is supposed to become profitable. This is a starter company that will have to undertake the development and keep on innovating so this is an expense that will probably won't go down. Look at the last chart, Price to sales ratio, this will have to be at a reasonable level compared with that of the competitors, which means that either the sales level will have to increase or the price of the stock will have to decrease, otherwise this will make it too expensive compared with the industry once this settles and becomes a "normal" car manufacturer company.

The Lithium Factor

Building an assembly plant from scratch is a humongous titanic work. Capital expenditures have gone to the outer space and still growing at a ludicrous pace, Research and Development costs are high, they have to do a lot of work and the gigafactory is draining gigamoney too. Tesla is burning cash like rocket fuel.

Once the gigafactory is working it will need basic materials to produce lithium batteries, lithium of course and spherical graphite among others, which are not traded as commodities in the futures market, so there’s no way to fix a future price on them except raw supply/demand from the direct market. The Gigafactory will require 150,000 tons of lithium, just to start. Thinking about a single vehicle or a low production assembly line is one thing, thinking about a mass production of 500,000 annual vehicles is another beast with its own rules and the scale economy comes into scene. The more they can save in building the batteries the more margin and the more profit. The more expensive the battery the more expensive the final vehicle price. The purpose of the gigafactory is to have an element to reduce the battery costs by massively producing them. However the factor that gravitates now it's not the cost of the battery, but the cost of lithium.

|

| Lithium increasing demand has made the price soar [25]. |

The 500,000 annual production goal will require large amounts of lithium, forget the millions of cars Tesla has to sell to reach Apple’s market cap, we'll discard that goal from the discussion.

World lithium reserves are 13 million tons, those are the good news, there is enough lithium in the world, but it has to be mined and processed, those are the bad news, there are few companies who hold the oligopoly of lithium production. If they form a single block they can give the lithium consumers a bad time by rising prices.

|

| Lithium Producers in the world [25] |

There are few countries in the world that can produce it, basically Argentina, Chile and China and the supply of this has its risks as stated by Joe Lowry also known as “Mr. Lithium” [13]. Tesla doesn't have an alternative like other car manufacturers who produce hybrids or who have the EV's as well as the traditional combustion engines in their assembly lines. Tesla only has the Lithium ion battery technology, and it is putting all the eggs in one basket. The fate of Tesla is directly related to Lithium. Currently their cost of battery is approximately $200 - $300 per KW Hour, the gigafactory will help reduce the costs, but lithium will rise them too by simple demand/supply.

|

| Demand will overwhelm supply by 2025 [25] |

Tesla model E an all-Electric sedan for the masses

It was announced this would make its debut in January 2015, by the time this article was written July 2015 the model E (today model 3) is still deferred a couple more years. Is Tesla thinking about a car for the masses? its priority is evidently the Model X, and there are three reasons for it, first the profit margin on a 100K+ vehicle is higher than the profit margin on a 35K model. Second, they must release model X, or the market will become impatient. And third, the credit for EV's granted by the IRS, which is for 200,000 vehicles [29], and it goes higher per each KW hour, my reasoning here is that a model 3 would count towards the 200,000 limit but the credit for it would be less than that of a Model X, or a Model S with ludicrous speed mode or even better a Roadster with ludicrous mode. Nothing personal with the EV for the masses, only business.

|

| Model E back in 2013, also known as Model 3 [30] |

|

I start to be concerned about the postponed production date of the model 3, since the margin and the credit are lower than the luxury Teslas. Margins are better for the more expensive models. Recently during the conference on July 17th, 2015 [31], Elon announced the Ludicrous mode in the P90 model and an upgrade for the P85 Model S sedan. This can be interpreted as the result of the additional research they had to do to increase the power for the Model X battery. Adding the upgrade to the existing model S doesn't meaningfully affect the assembly line and it adds more glamour to the Tesla owner, which is where the company seems to be heading after all. They announced the relaunch of the Tesla Roadster with ludicrous mode, its original muscle car, but there were no mentions about model 3. So no updates of the car for the masses. It would create a bigger positive green impact if the masses and the average Joe and Jane could drive a Tesla, rather than a few ones who can afford the expensive models, but being realistic a public company is about margin, being profitable and the shareholders come first since they are the ones who have the power to raise or lower the share price. If model 3 and the green car for the masses increases revenue and share price, it is more than welcome, if not, just keep it in the drawer by now and focus in what produces margin.

The options granted to the Tesla insiders

When it comes to any publicly traded company, insider transactions is something that has to be tracked because this is a sign something is happening or something is going to happen with the company. If the insiders are selling it doesn't necessarily mean bad news, if they're buying those are good news, but if what they are doing is to trade options on their own company that's a different story. They are actually not buying shares, and they aren't technically dumping their stock. Those are options.

In the case of Tesla there were several option related transactions. According to the SEC filings, on June 18, 2015 several insiders received each one 50,000 options as part of a triennial equity award. The SEC [32] filing refers to this as "This stock option award is a triennial equity award granted pursuant to the Company's 2010 Equity Incentive Plan and Outside Director Compensation Policy. 1/36th of the shares granted shall become vested and exercisable as of each monthly anniversary beginning on July 18, 2015, such that all shares subject to the Option shall be fully vested and exercisable by June 18, 2018."

The beneficiaries of this award on June 18th were Denholm Robyn M, Jurvetson Stephen T, Gracias Antonio J., Ehrenpreis Ira Matthew, Buss Brad W, Musk Kimbal totaling 300,000. With an exercise price of $261.89. So we can expect option related SEC filings from the insiders for the next three years. I will not speculate on this but the price level and the number of shares are two more variables that will have to be added to the Tesla equation.

Denial is strong with this one

Stocktwits[21] has been for me a barometer to gauge the market perception on a particular stock. In this case I have noticed a strong denial from the Bull side. Myself I am a swing trader, not a permabull not a permabear, I go with the swings, and the trends. As a matter of fact I called the current peak back a little after I published my chart “A perfect timed twit” [22] when I said that the twit by Elon Musk was timed after the technical analysis at the time when it was hitting the support levels and there were strong positive momentum divergences, it was a spark plug that ignited the current trend. It behaved as expected, no surprises and I didn't receive as many critics as when I published the end of the trend on a series of published charts where I called the head and shoulders and the negative momentum divergences close to the 250~ish level. Nothing else but mass psychology and denial. If something is profitable and grows, the mind plays tricks creating the illusion of permanence and continuity, the illusion of "the sky is the limit". We can all easily fall in a comfort zone and think this will skyrocket and last forever, same thing happened with the tulip bulb traders. And even if there is evidence we can always disguise it, neglect it or discard it, no matter how evident this is. Not everybody can switch sides and play both sides of the market, it is not as easy as switching gears. Currently the level of denial is big here, this is a symptom of euphoria. And it is perfectly valid. Euphoria can also be traded. Assuming that Bulls will enter into the frenetic race to bid higher and if eventually they make bears capitulate before the market rotation is due they could break the all time highs, which doesn't mean the price will go unboundedly high, it means there will be a spike and the retracements will be more painful, remember price follows value, not the other way. Especially if future valuation has already been set. This is the big warning here.

This is what Alan Greenspan used to call the irrational exuberance. He had to change his posture and just be ready when the market collapsed due to its own weight. Numbers exist at the rational level and they cease to exist at the emotional euphoric level. It is useless to reason with numbers when the euphoria takes over. The mind tends to see a line when it comes to future projections. One of the traders referred to Tesla as a “Mass Psychology” traded stock.

Mass Psychology

Tesla buyers are attracted not by the original reason why the institutional buyers jumped in the trade in the first place. Most of them don't even know it, and don't bother to know, as long as it keeps on going higher. By following the basic principle of trade first, ask later, a reason will be found along the road. This creates euphoria, which drags more and more irrational buyers and evidently the imbalance will make the prices go higher. Euphoria is at the emotional level, and there is no way to reason with it. When Euphoria becomes pandemic and contaged to the masses this is even worse. The only thing to do is to ride the bubble being perfectly aware at all times that it is the bubble inflated with hot air made of euphoria, hope, limitless prices, and the illusion of continuity that drives the price, not fundamentals nor real present nor future valuations and it may burst at any time.

People, be careful on this one, it is enough that some of the institutional buyers consider Tesla is not going on the right direction to in cold blood without a warning take profits and run, igniting an stampede. Remember the trend is your friend until that nasty bend and the end, just keep your trading plan strict and your expectations flexible, not the other way. At the end of the day it is you who press the buy or sell button, it's nobody else's but your own risk your own reward and your own trade. Do it informed. Good Luck and good trading.

Conclusions

Trading Tesla requires different strategies, this is not driven by standard valuation and the price is very sensitive to news and events. The main metric is the number of vehicles delivered that keep the long term goal of 500,000 year production in line. Model X is a key factor for the success of the company and the future is dangling on this. There are several risk factors to consider like the lithium supply the overall discretionary market and in particular the vehicle industry, oil prices, and the Chinese economy just to name a few.

Key levels for this stock are 180 and 280. There is a heavy bear on top of this stock even at levels close to all time highs which means there is conviction on the bear side which raises a warning signal.

Electrical Vehicles is one of the future green technologies, but not the only one. This area is in development and it still has a long way to go. So we can expect in the following years emerging and falling companies until this settles.

References

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

- The tulipmania. https://en.wikipedia.org/wiki/Tulip_mania

- Dirty, Dangerous and Expensive. http://www.psr.org/resources/nuclear-power-factsheet.html

- lithium supply vs. demand http://www.bloomberg.com/news/videos/b/3abb52e4-ea59-4ed9-8525-80e5765c701c

- Elon Musks' lithium revolution https://www.energyandcapital.com/articles/elon-musks-lithium-revolution/4937

- Tesla's Lithium Supply Constraints Might Hamper Its Growth http://www.forbes.com/sites/greatspeculations/2015/03/16/teslas-lithium-supply-constraints-might-hamper-its-growth/

- Ready to pump out 100,000 by January 2015. http://www.bloomberg.com/bw/articles/2014-07-31/elon-musks-tesla-game-plan-make-100-000-cars-next-year

- Plug in Electric Drive Vehicle http://www.irs.gov/Businesses/Plug-In-Electric-Vehicle-Credit-IRC-30-and-IRC-30D

- Tesla model E for the masses http://www.slashgear.com/tesla-model-e-an-all-electric-sedan-for-the-masses-to-debut-jan-2015-15308891/

- The ludicrous mode conference. https://www.youtube.com/watch?v=6ThrNtJm7ko&feature=youtu.be

- Form 4 SEC filings (Statement of changes in beneficial ownership of securities) http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001318605&type=&dateb=&owner=only&count=40

- Stock price "more than we deserve" http://www.bloomberg.com/news/videos/b/cdfd942e-8786-4d67-8ffb-e59a52923553